2020 Reassessment Hub

Please Note

The Ontario government has announced that the 2020 Assessment Update has been postponed. They have indicated that property assessments for the 2021 property tax year will continue to be based on the fully phased-in January 1, 2016 current values. To view updates from MPAC regarding COVID-19, please visit their COVID-19 Updates for Our Partners page.

For municipalities, property tax is an important source of revenue to support the delivery of community services. In 2020, the Municipal Property Assessment Corporation (MPAC) will update the value and classification of every property in Ontario. What does this mean for your municipality?

MFOA, in partnership with the

Municipal Tax Equity (MTE) Consultants Inc., are providing our members with various resources to help the strategic CFO prepare for the 2020 reassessment and its implications. This Hub page will be regularly updated with new resources. This Hub will also include key resources from various associations such as MPAC and OMTRA.

MFOA will continue to advocate on behalf of its members on this important issue. For any questions, please contact Colion Macdonald (

colin@mfoa.on.ca).

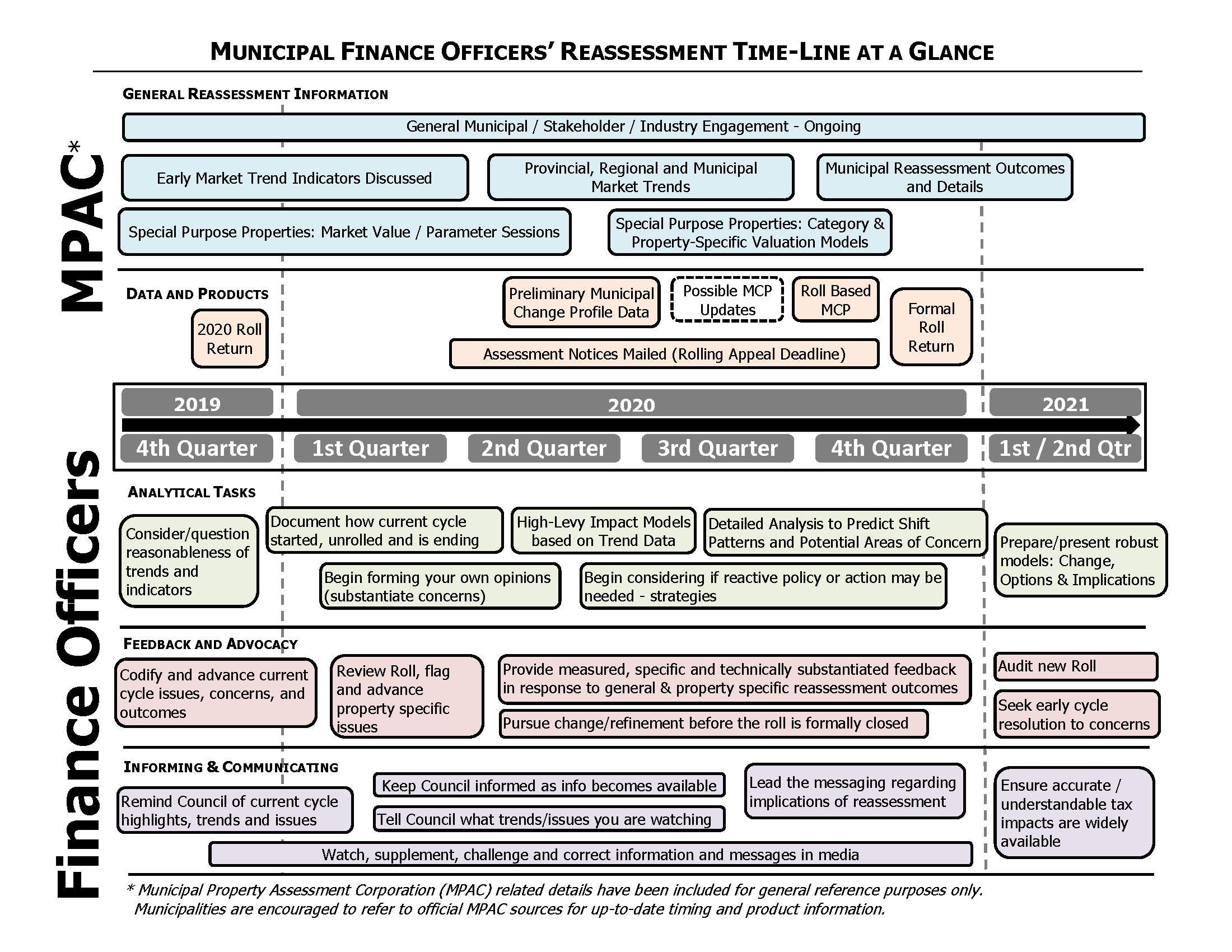

Municipal Finance Officers' Reassessment Timeline at a Glance

A reassessment cycle is an involved process for municipal finance staff. Stay ahead of the curve with our reassessment timeline at a glance. View the image below or download the pdf copy to keep at your desk.